7 things the CDO needs to know about ESG

For the Chief Data Officer there’s a lot open to interpretation when it comes to their environmental, social and corporate governance obligations and objectives. Here are 7 areas that are key to successful ESG strategy and practice.

The ‘Why’

1. ESG needs to 'live’ in business structures and data cultures

If you view ESG as a simple box-ticking exercise that a business needs to comply with to appear more environmentally conscious, you risk facing more serious challenges down the line. If an ESG strategy isn’t well thought out and all-encompassing, it will not only make the implementation process harder but will leave gaps in the dataset when more stringent standards and requirements are developed. For the CDO, recognising that everyone within an organization has a responsibility to the data will help embed a culture around ESG that is built into business mindsets and structures.

2. Mistrust and the burden of regulations

For most companies, it’s common for stumbling blocks to appear within data sourcing and governance. With no clear standards and ongoing changes in regulations, transparency throughout an organization with clear objectives is key to overcoming ESG data challenges. The CDO knows they must first get a handle on their data and understand how it flows through the company.

Processes need to be streamlined and automated, with progress diligently tracked to avoid missing targets. The ability to uncover hidden connections in the data as well as key points that can be fed into an automated process can improve efficiency of reports and provide a road map for implementing improvements.

3. ‘Greenwashing’ is a thing and it’s detrimental to your organization’s reputation – transparent reporting protects against it

Businesses that ‘greenwash’ give false impressions that they are more environmentally sound and conscious than they really are. Their products and ethos don’t match what they are saying externally, and this is often uncovered in their own reporting. Making sure reporting is accurate and transparent from beginning to end – even if it doesn’t always match your desired ESG objectives and goals – can help an organization avoid misleading the public and potential investors.

The ‘How’

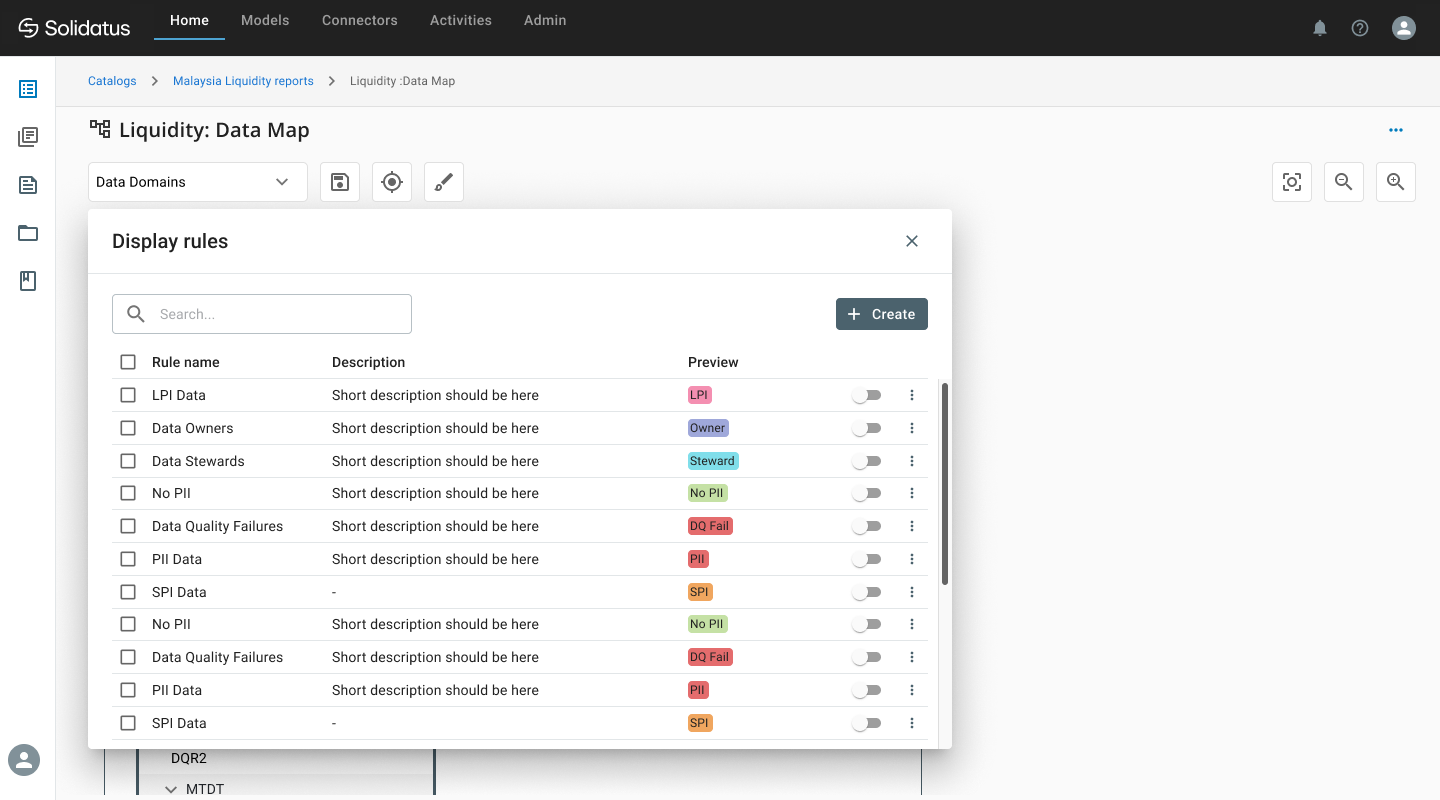

For years, Solidatus has been empowering data-rich organizations to navigate their data landscapes, making smarter decisions and driving better business outcomes. In short, our mission is to turn everyone into a data expert. We recently announced our latest innovation: a revamped interface featuring a business-friendly data map view and the world’s first lineage-enabled data catalog. This marks our unwavering commitment to driving AI, Cloud and Regulatory success with data you can trust.

Let’s dive deeper into how Solidatus is empowering everyone to unleash their inner data expert.

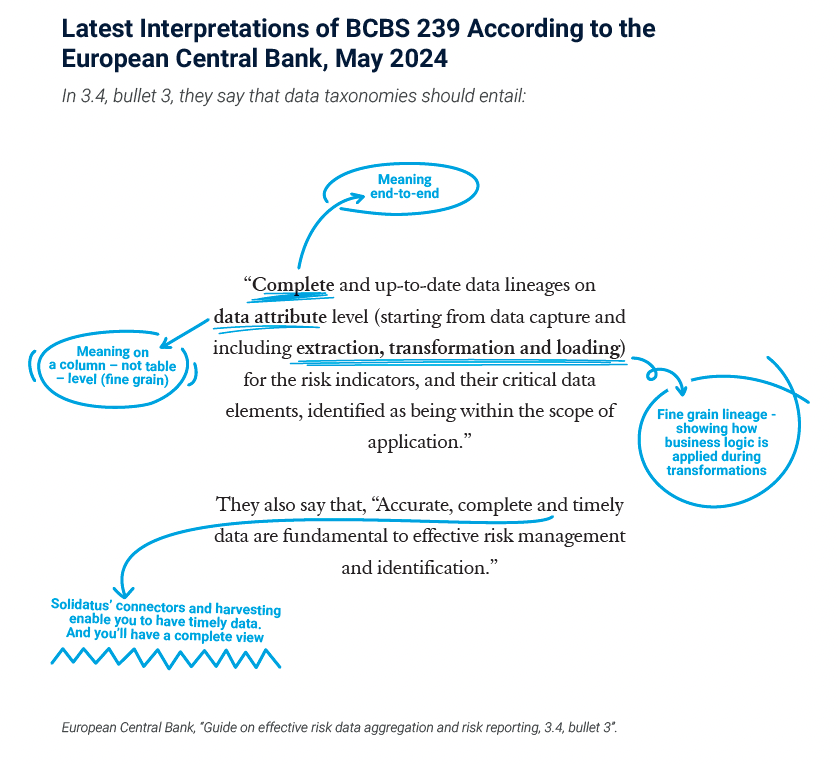

4. ESG reporting is evolving all the time so current frameworks and strategies will need to evolve too

Factors such as climate change, sustainability and social governance continue to advance, so standards and reporting are evolving with them. Frameworks need to be formed on transparency and innovation, not remain rigid. So as reporting continues to shift and develop, strategies move with them and continue to yield credible results that are easy to interpret.

5. In the absence of industry standards, internal standards are key

One of the best ways to demystify the complexities around ESG and the lack of standardization is to create and implement internal ESG taxonomies – thoroughly understood throughout an organization – to avoid ambiguity. Agreeing on well-defined internal standards, requirements and policies can help businesses clear up uncertainties in data strategies, as well as make it easier to reach ESG objectives.

6. It’s important to be innovative – the right software helps you meet requirements and create scalable solutions

For the CDO, horizon-scanning is incredibly important. Researching and understanding new technologies will keep businesses ahead of the innovation curve. By integrating an organization’s metadata with an agile cloud-based platform, ESG initiatives can be tracked and reported on against relevant ESG standards and disclosures.

The ‘Who’

7. A data blueprint can show you how your data flows around your organization and give you transparency on its context and the people and processes that impact it

Given its complexities, it’s so important that ESG data in an organization is clear and linear. It needs to be reaching the right people at the right time, as well as flowing into the correct processes. With the Solidatus solution, you can build a data blueprint that gives your business the visualization of your data that you need to ensure it is moving into the right places, giving a strong foundation for not only current compliance needs but to uncover opportunities that will enhance your overall strategies and approaches to ESG.

Solidatus gives businesses the power to build and implement successful, future-proof ESG strategies that not only help them manage and visualize data to achieve regulatory compliance, but to more importantly leave a positive and lasting change on the planet – which is the goal no organization can afford to lose sight of.

Get a free preview of Solidatus to learn more about how our solution can help you build your data strategy, understand data lineage, and achieve ESG goals.