Achieving Basel III compliance: A 3-Step action plan

Basel III is changing – are you prepared?

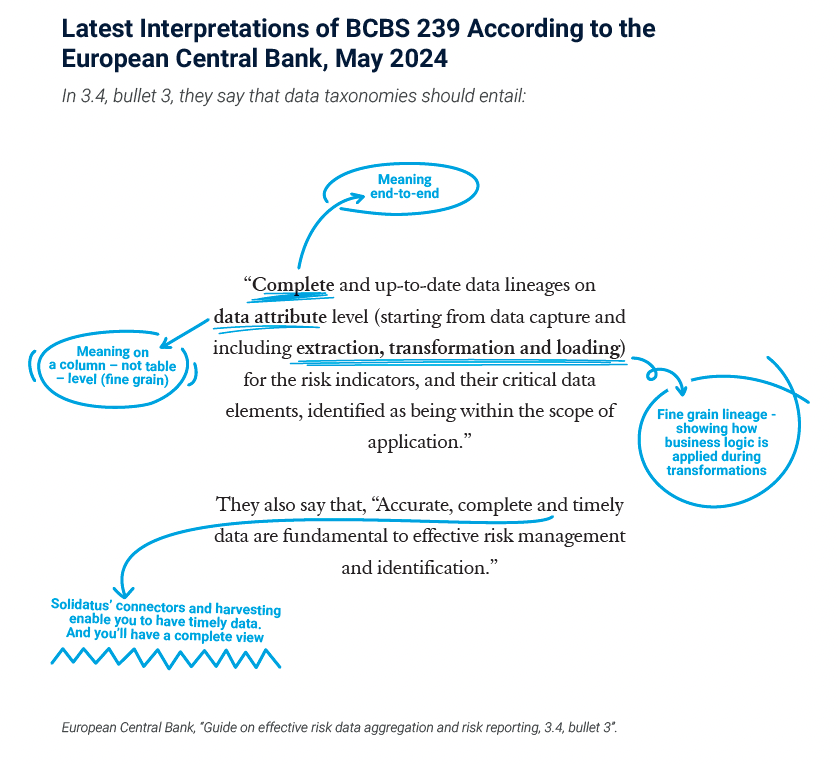

New reforms target the recalculation of risk-weighted assets and limiting banks’ use of internal models for risk estimation in setting minimum capital requirements. Systemically important banks face heightened stress testing and risk data requirements, while expanded reporting rules and risk assessments present new challenges for regional players.

This presents big challenges:

- Manual processing leads to errors, wasting valuable time.

- Complex processes and data silos hinder collaboration and visibility.

- Expanding data volumes strain legacy systems, while new attributes are often unavailable or require substantial effort to source.

While the challenges may appear daunting, they don’t have to be. With Solidatus, you can achieve full compliance and more in three simple steps.

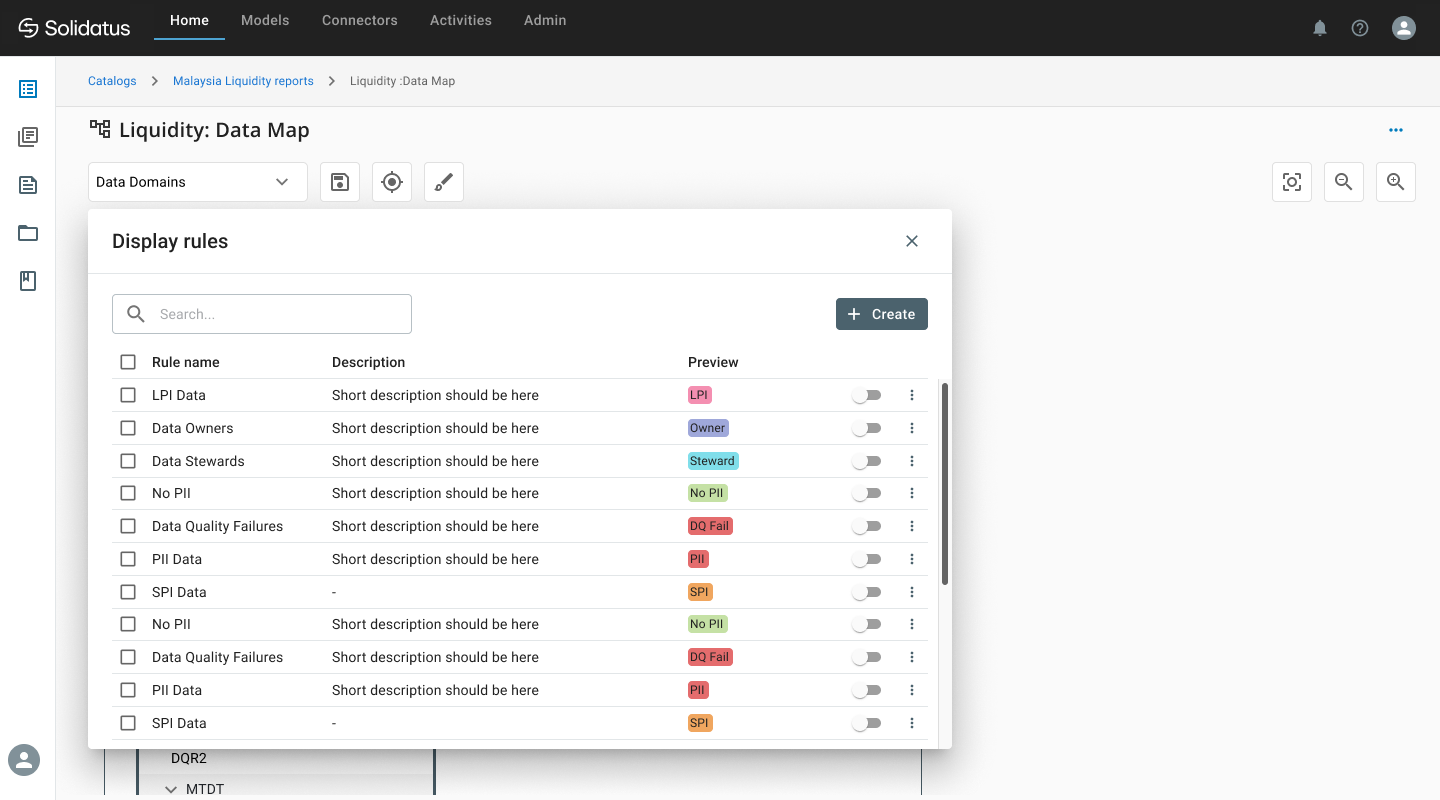

By combining technical data lineage with business context we connect your data to the processes that create it, to the policies that guide it, and to the obligations that regulate it. The result is a ‘live’ enterprise data blueprint that clearly illustrates the impact of Basel III on every layer of your organization.

3 simple steps to achieving full compliance

Solidatus in action: Technology demonstration

Watch a short video or download our factsheet learn how a Solidatus user can tackle regulations like Basel III head-on.