The Big Green Short, asset management and me

Sustainable Finance and ESG Funding

Amongst the tsunami of news and information created around ESG over the last 10 years, most asset managers have focussed their efforts on offering ESG-labelled products to investors who want to use their investments to help manage climate change and to promote positive changes in the world.

So what’s the problem? Surely things are going in the right direction and everyone’s investments are safe, right?

Maybe.

But the trouble is that while this approach has seen large inbound flows of investment into green funds, there are concerns that ESG funds are not always as green as they may have seemed, and there is increasing regulatory worries that not all these green-labelled funds are quite what they seem.

Furthermore, few organizations have significant ESG knowledge and experience, and therefore lack the capability to understand the full requirements and report reliably.

Reporting on greenhouse gas emissions within your business

Like all large organizations with a European presence, asset managers, insurers and other large investors must report the greenhouse gas emissions.

To date, most of the focus around ESG and asset managers has been centered on the distribution side of the business and the development and marketing of ESG-related products for investors.

This paper highlights that there are some real, practical issues with this approach.

Asset managers, insurers and other large investors should look to report on wider greenhouse gas emissions within organisations, namely on the ESG performance that their organizations make directly, the emissions that are made indirectly, and then all the emissions that the organization is indirectly responsible for, up and down the value chain.

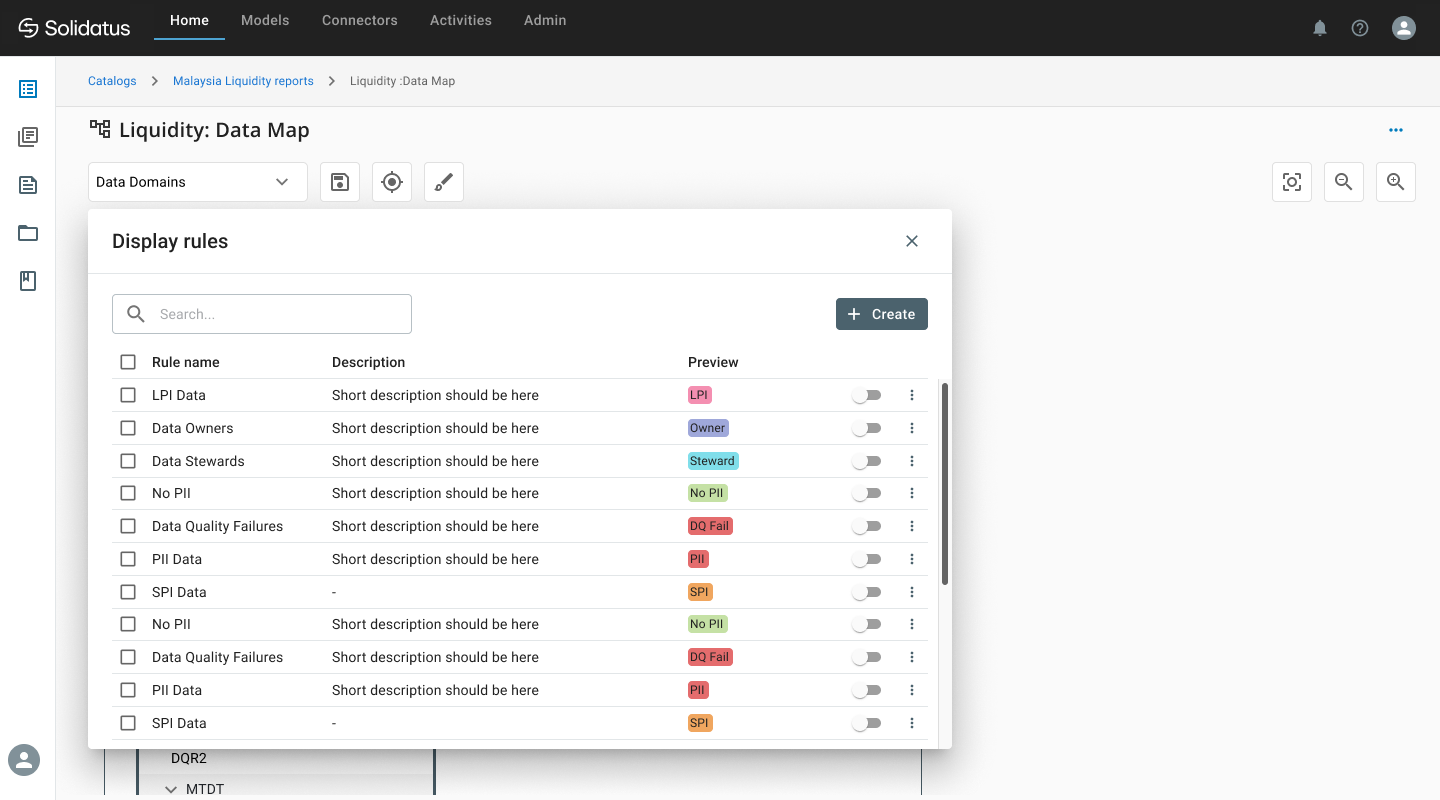

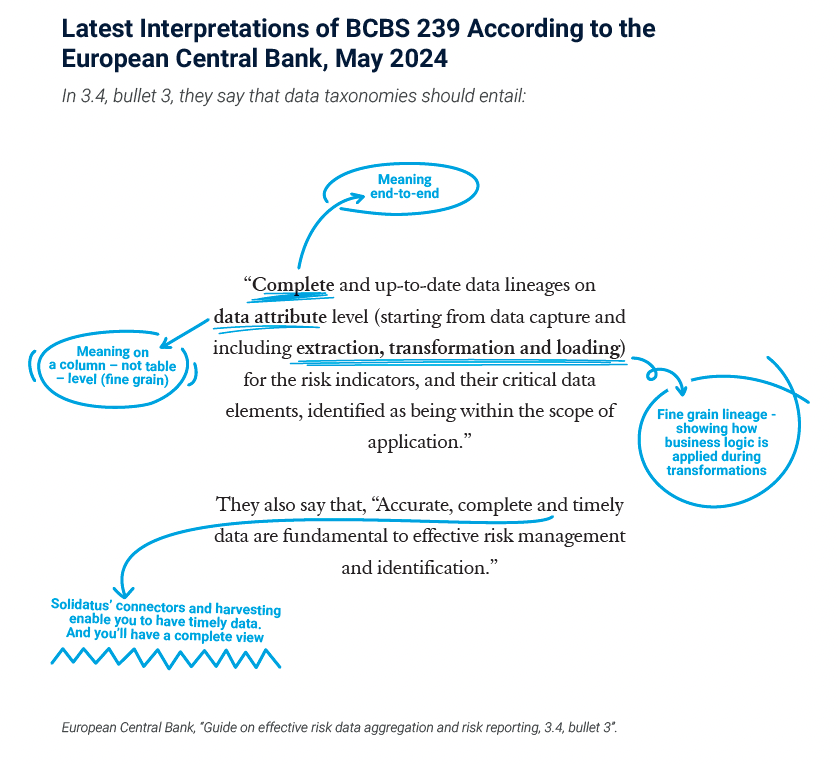

Data lineage modeling is essential to demonstrate the source and completeness of data in your emissions reports.

The Big Green Short concept

The Big Green Short is the concept that, over time but faster than many firms are ready for, all asset prices are going to be impacted by their relative investment performance (as now) but also in the ratings and changes in ratings across ESG criteria.

This means that asset managers need to support ‘green’ investors and provide wide access to green assets. It also means that an increasing volume of investment dollars is going to be targeting ‘green’ assets.

Where asset prices are going to change in a systemic way there will be an opportunity for first movers to generate large profits by seeing increases in value of assets they hold, and the ability to exit assets which will see price falls (and even to short assets they expect to drop in value significantly).

Download this white paper to:

- discover what asset managers should do in the short term

- understand Scope 1, 2 and 3 emissions

- learn about ‘The Big Green Short’ and how to avoid falling prey to it.

Access your content